CME's "Glitch": What Really Happened & Who Pays - Meltdown Ensues

7|0 comments

So, the Chicago Mercantile Exchange, the place "where the world comes to manage risk," huh? More like the place where the world gets a front-row seat to watch the digital infrastructure crumble. Trading halted, markets in chaos, trillions of dollars hanging in the balance – all thanks to a "cooling issue" at a data center. A cooling issue! Give me a break.

Squirrels vs. the Global Economy: Who Ya Got?

The Inevitable Breakdown It's always something, isn't it? A software bug, a hardware failure, a cyberattack... or a damn squirrel chewing through a power line. Remember that one? August 2, 1994. A squirrel took down Nasdaq. You can't make this stuff up. We're entrusting the global economy to systems that can be foiled by rodents and faulty air conditioning. What does that say about our priorities? And let's be real, this CME outage wasn't just a blip. It lasted for hours, leaving traders "flying blind," according to some analyst quoted in the news. "Flying blind!" That's putting it mildly. More like free-falling into a pit of uncertainty while the algorithmic overlords take a coffee break. Then again, maybe I'm being too harsh. Maybe these glitches are just the cost of doing business in the 21st century. After all, speed and efficiency come at a price, right? We want instant transactions, high-frequency trading, and all the bells and whistles of modern finance. But what happens when the whole damn system grinds to a halt because someone forgot to check the thermostat?Another Day, Another Digital Dumpster Fire...

A History of Digital Fumbles This ain't even the first time, offcourse. The article I was reading listed a whole damn litany of exchange outages over the years. Moscow, Switzerland, London, New York... it's a global epidemic of digital incompetence. Remember Facebook's IPO in 2012? Technical glitches galore, traders left in the dark, and substantial losses for everyone involved. And who paid the price? Not the fat cats at Nasdaq, that's for sure. It makes you wonder, doesn't it? Are we really in control of these systems, or are they controlling us? We've built this intricate web of digital dependencies, and we're completely at its mercy. A single point of failure can bring the whole house of cards crashing down. And the worst part? Nobody seems to have a real solution. Just a lot of hand-wringing and promises to "improve" the system. Yeah, right.CME: "Manage Risk" or Gamble on Control?

The Illusion of Control The CME Group calls itself the place "where the world comes to manage risk." That's rich. It's more like the place where the world comes to gamble on the illusion of control. We pretend that we can predict the future, hedge against uncertainty, and master the market. But the truth is, we're all just along for the ride. We're passengers on a runaway train, hurtling towards an unknown destination. And these outages? They're not just glitches. They're wake-up calls. They're reminders that our digital infrastructure is fragile, our systems are fallible, and our control is an illusion. So, what's the answer? I don't know. Maybe we need to slow down, take a deep breath, and re-evaluate our priorities. Maybe we need to focus on building more resilient systems, not just faster ones. Or maybe we're all just doomed to repeat the same mistakes, over and over again. So, What's the Real Story? Honestly, it's just pathetic. We're so busy chasing profits and pushing the limits of technology that we've forgotten the basics. A cooling issue? Seriously? It's like building a skyscraper on a foundation of sand. Sooner or later, it's gonna collapse. And when it does, don't be surprised if the whole damn world comes crashing down with it.-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

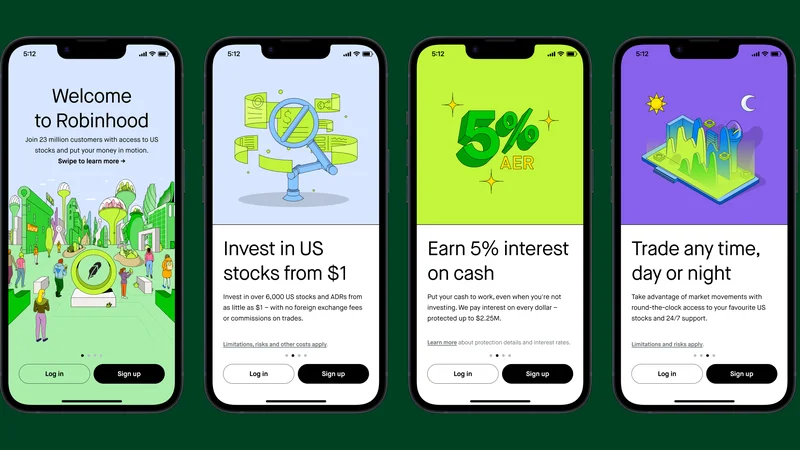

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- CME's "Glitch": What Really Happened & Who Pays - Meltdown Ensues

- Why Tether's Uruguay Exit is a Bitcoin Breakthrough (RIP Bitcoin Uruguay)

- Fintech 2025: Innovation or Just Data Reframing? - Thoughts?

- AI: Unlocking Your Channel's Evolution - Redditors Rejoice!

- Bitcoin Jumps: Dead Cat Bounce? - Crypto Twitter Reacts

- Uber Ride Demand: Cost Analysis vs. Thanksgiving Deals

- Stock Market Rollercoaster: AI Fears vs. Rate Hike Panic

- Bitcoin: The Price, The Spin, & My Take

- Asia: Its Regions, Countries, & Why Your Mental Map is Wrong

- Retirement Age: A Paradigm Shift for Your Future

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)