Bitcoin Holds the Key: The Truth About December's Rally - Crypto Twitter Reacts

7|0 comments

Bitcoin, it seems, is perpetually caught between the promise of a holiday rally and the cold, hard slap of market realities. The end of the year is supposed to be Bitcoin's time to shine, but recent Decembers have been less "Santa rally" and more "Grinch stole the crypto." So, what's the real story?

December Bitcoin Rallies: Fact or Wishful Thinking?

The Ghost of Decembers Past There's a narrative that December is Bitcoin's golden month. History suggests an average increase of around 20% (Alex Kuptsikevich at FxPro cites 29.7% over 14 years). But averages can be deceiving. As the saying goes, a man can drown in a lake with an average depth of three feet. A closer look reveals a more turbulent truth. While some Decembers have delivered eye-popping gains—like 2017's 51% surge—others have been brutal. Take 2018, for example, which saw a 37% decline amid tightening macro liquidity. That's not exactly the Christmas bonus crypto enthusiasts were hoping for. The problem is that the "December rally" narrative often glosses over the inconvenient fact that past performance is no guarantee of future results. It's a classic case of cherry-picking data to fit a pre-conceived storyline. And let's be honest, the market loves a good story. The idea of a predictable, seasonal surge is comforting. But the data suggests something far less predictable: a coin highly susceptible to broader market forces, with occasional bursts of irrational exuberance sprinkled in.Bitcoin's Perfect Storm: Fear, Yen, and a Whale Named Strategy

Macro Headwinds and Strategy Shifts Looking at the factors influencing Bitcoin's recent performance, several themes emerge. A primary one is the "risk-off" mood that seems to be gripping the markets. Bitcoin, despite its proponents' claims of being a decentralized, uncorrelated asset, often trades in tandem with high-growth tech stocks. When investors get nervous, they tend to dump both. The CNN Fear and Greed Index, hovering in "Extreme Fear" territory, tells you all you need to know. Then there's the yen carry trade. The Bank of Japan hinting at interest rate hikes (a rare event these days) sent ripples through global markets. The fear is that investors will unwind their positions in US markets to cover their yen borrowing, putting downward pressure on assets like Bitcoin. It's a complex web of interconnected financial instruments, and Bitcoin is just one thread. Liquidity, or the lack thereof, is another major concern. ETF outflows in November totaled $3.5 billion, which is a significant chunk of change. Bitcoin's market depth, a measure of its resilience to large trades, has also declined. A shallower market means that even relatively small sell orders can trigger significant price drops. And this is the part of the report that I find genuinely puzzling. The actions of Strategy, the OG Bitcoin treasury company, add another layer of uncertainty. The company hinted at the possibility of selling some of its massive Bitcoin holdings if its valuation dips below a certain level. Strategy holds approximately 650,000 Bitcoin, or about 3% of the total supply. If Strategy starts selling, it could trigger a domino effect, sending prices spiraling downward.Bitcoin's December: A Wild Ride Continues

The Bouncing Ball of Bitcoin Fast forward to December 2025, and we see Bitcoin attempting to stabilize around $87,000 after a sharp sell-off. Bitcoin Price Today, December 2, 2025: BTC Holds Around $87,000 After Violent December Sell-Off The early December crash wiped out close to $1 billion in leveraged crypto positions, extending its decline to about 30%—no, wait, more precisely, 33% below its October all-time high. The reasons cited for this latest dip are familiar: global risk aversion, uncertainty surrounding Federal Reserve policy, and, of course, good old-fashioned leverage and liquidations. The market is caught between oversold conditions that *could* fuel a rebound and persistent headwinds that *could* trigger another plunge. It's a bouncing ball with no clear direction. On-chain data paints a mixed picture. Some analysts point to whales (large Bitcoin holders) selling off their coins, while others highlight a decline in exchange reserves, suggesting that sell-side pressure is easing. Options data also reflects this uncertainty, with traders hedging against further downside risks. So, what does it all mean? It means that Bitcoin is still a highly volatile asset, prone to wild swings and susceptible to a wide range of external factors. The dream of a predictable December rally is just that: a dream. The reality is far more complex. So, What's the Real Story? Bitcoin is not a reliable Christmas present. It's a high-risk, high-reward gamble that demands constant vigilance and a strong stomach. Anyone who tells you otherwise is selling something.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

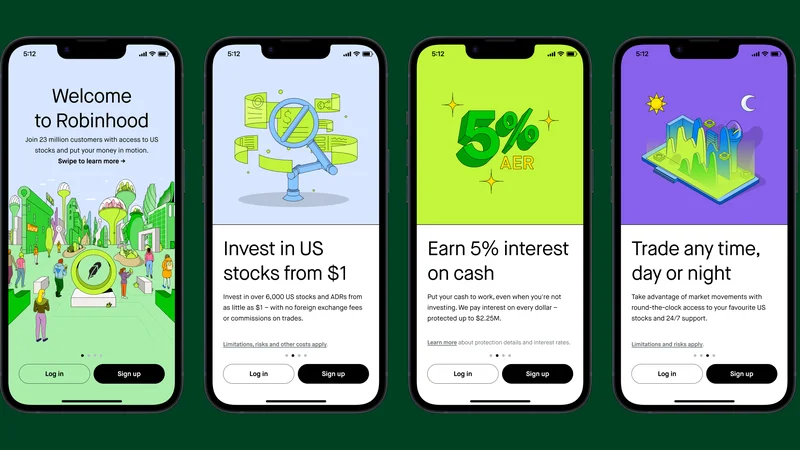

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- Beyond the Headlines: Crypto's Unstoppable Future. (- #CryptoInsights)

- 2025 Economy: Uncertainty Is A Convenient Lie

- Zcash, Aster, Solana and the Grand Santa Rally: Is This Our Breakthrough Moment?

- Bitcoin Holds the Key: The Truth About December's Rally - Crypto Twitter Reacts

- The Pink Pineapple: Unlocking the Future of Flavor and Viral Trends

- Monday's Market: Unlocking Tomorrow's Breakthroughs - Stock Shock!

- CME's "Glitch": What Really Happened & Who Pays - Meltdown Ensues

- Why Tether's Uruguay Exit is a Bitcoin Breakthrough (RIP Bitcoin Uruguay)

- Fintech 2025: Innovation or Just Data Reframing? - Thoughts?

- AI: Unlocking Your Channel's Evolution - Redditors Rejoice!

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)